I.Introduction

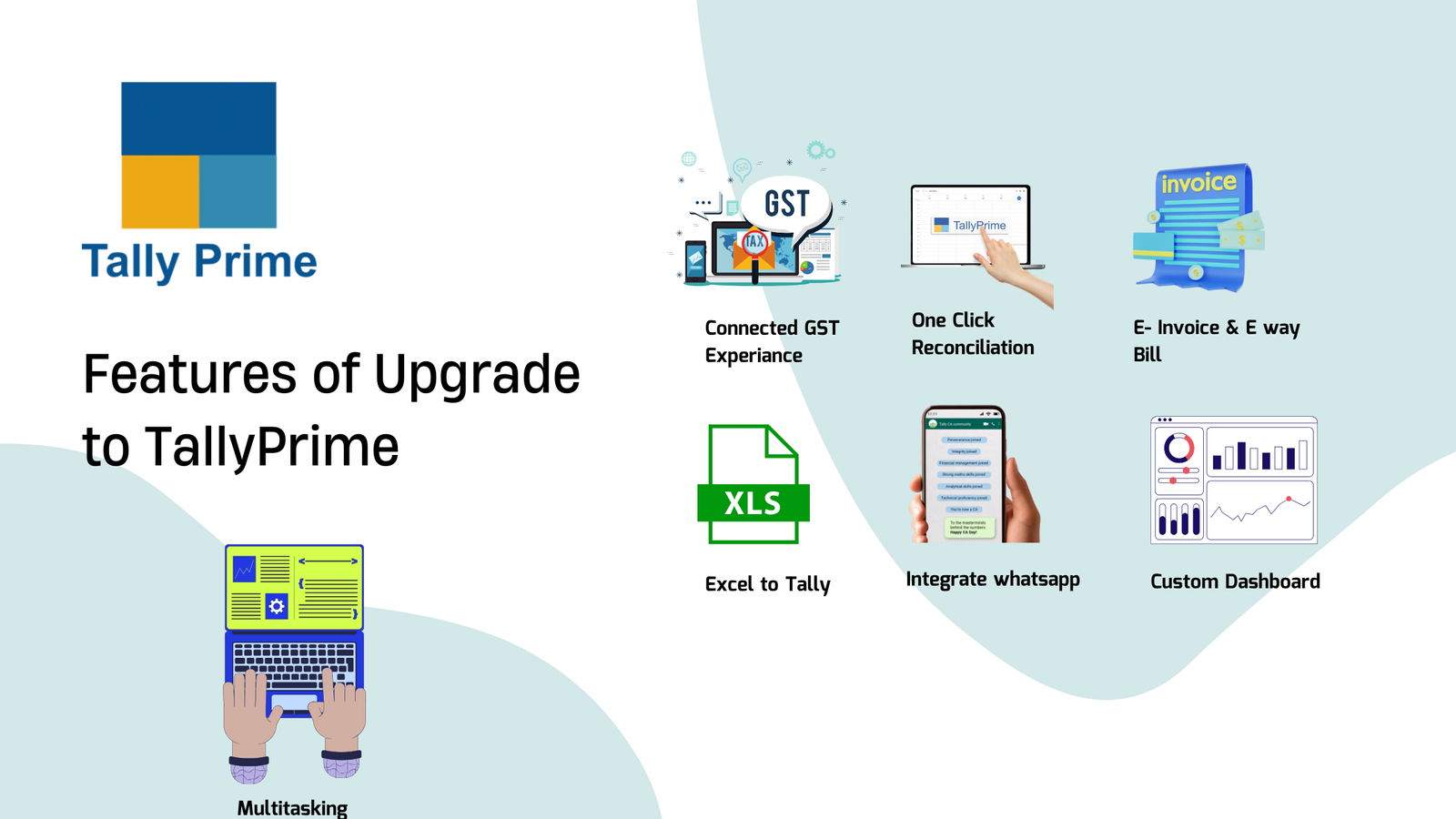

Upgrading to the latest version of software like TallyPrime is crucial for enhancing business operations. It ensures access to the latest features, improved security, and compliance with regulatory changes. Additionally, updates often include performance enhancements and user-friendly interfaces, which can significantly boost productivity and streamline processes, ultimately driving business growth.

1. Connected GST

TallyPrime simplifies GST compliance through its Connected GST feature, allowing users to upload GSTR-1 and GSTR-3B directly to the GST portal from the software. This integration minimizes manual data entry errors, automates GST calculations, and ensures timely filing, enabling businesses to maintain accurate records effortlessly and stay compliant with regulations.

Real-time updates in TallyPrime ensure that financial data is always current, reflecting the latest transactions and regulatory changes. Automatic tax calculations eliminate manual errors, streamline compliance, and reduce the risk of penalties. This efficiency allows businesses to focus on strategic decision-making rather than getting bogged down in administrative tasks.

Staying compliant with changing regulations is crucial for businesses to avoid legal penalties, maintain operational integrity, and build trust with stakeholders. Compliance ensures that financial practices align with current laws, reducing the risk of audits and fines. Moreover, it enhances a company's reputation and fosters a culture of accountability and transparency.

2. Real-time 2A Reconciliation

The GSTR 2A reconciliation process in TallyPrime involves comparing the GST transactions recorded in your books with the data from the GSTR 2A statement. Users download the latest GSTR 2A data from the GST portal and import it into TallyPrime. The software then identifies discrepancies, allowing businesses to rectify mismatches and ensure accurate GST compliance.

Real-time reconciliation in TallyPrime allows businesses to instantly compare their accounting records with GST data, identifying discrepancies as they occur. This immediate feedback ensures that errors are corrected promptly, resulting in more accurate financial records. It enhances compliance, reduces the risk of penalties, and fosters greater trust in financial reporting.

3. E-Invoice & E-Way Bill in One Click

TallyPrime offers integrated e-invoicing and e-way bill features that streamline compliance with GST regulations. Users can generate e-invoices directly within the software, ensuring automatic population of necessary details for e-way bills. This seamless process simplifies invoicing and shipping, significantly reducing manual effort and enhancing operational efficiency for businesses.

Generating invoices and e-way bills seamlessly streamlines the billing process, reducing manual errors and saving time. This automation ensures compliance with regulatory requirements, enhances accuracy, and facilitates faster transactions. Additionally, it improves cash flow management by expediting payments, ultimately leading to a more efficient and organized financial operation for businesses.

For businesses managing large volumes of transactions, TallyPrime's features significantly reduce time spent on manual entry and reconciliation. Automated processes, such as one-click e-invoicing and seamless data imports from Excel, streamline workflows, allowing teams to focus on strategic tasks rather than repetitive data management, ultimately enhancing productivity and efficiency.

4. Excel to Tally Import

Importing data from Excel into TallyPrime streamlines the accounting process by allowing users to transfer large volumes of data efficiently. Users can download predefined templates, populate them with relevant information, and then import this data directly into TallyPrime. This feature reduces manual entry errors and saves significant time, enhancing overall productivity.

This feature significantly enhances data entry efficiency by allowing users to import data directly from Excel into TallyPrime. By minimizing the need for manual input, it reduces the likelihood of human errors, ensuring greater accuracy in financial records. This streamlined process saves time and improves overall productivity for businesses.

Transitioning from manual accounting to automated systems is crucial for businesses as it enhances accuracy, reduces human error, and saves time. Automation streamlines financial processes, enabling real-time data access and reporting. This shift allows businesses to focus on strategic decision-making and growth, ultimately improving efficiency and competitiveness in the market.

5. Integrate TallyPrime with WhatsApp

TallyPrime's integration with WhatsApp for Business revolutionizes communication by enabling businesses to send invoices, payment reminders, and updates directly to customers via WhatsApp. This feature enhances customer engagement through real-time notifications, streamlining interactions and fostering a more personalized connection, ultimately improving customer satisfaction and operational efficiency.

Sending invoices, reports, and updates directly via WhatsApp enhances communication efficiency by allowing businesses to reach clients instantly. This method ensures timely delivery, reduces delays, and fosters a personal touch in client interactions. Additionally, it streamlines follow-ups and approvals, improving overall responsiveness and customer satisfaction in business transactions.

6. Custom Dashboards

TallyPrime's customizable dashboards offer businesses the ability to tailor their data visualization according to specific needs. Users can create unique dashboards by adding, removing, or rearranging tiles that display key metrics. This flexibility enhances decision-making by providing a comprehensive view of financial performance, inventory status, and sales trends, all in real-time.

Data visualization plays a crucial role in informed decision-making by transforming complex data sets into easily understandable visual formats, such as charts and graphs. This clarity enables stakeholders to quickly identify trends, patterns, and anomalies, facilitating faster insights and more effective strategies, ultimately leading to better business outcomes and enhanced operational efficiency.

7. Multitasking in TallyPrime

Accessing multiple reports and tasks simultaneously in TallyPrime enhances workflow efficiency significantly. This feature allows users to consult various data points—like sales invoices and inventory reports—without losing progress on ongoing tasks. Consequently, it minimizes disruptions, streamlines decision-making, and fosters a more productive work environment, ultimately driving better business outcomes.

The multitasking capabilities of TallyPrime significantly enhance productivity and workflow efficiency by allowing users to access multiple reports and functions simultaneously. This reduces the time spent switching between tasks, minimizes interruptions, and streamlines processes, enabling teams to focus on critical activities and make quicker, informed decisions for better business outcomes.

8.Conclusion

Upgrading to TallyPrime represents a pivotal step for businesses seeking to enhance their operational efficiency and compliance. With features like Connected GST, real-time 2A reconciliation, and seamless integration of e-invoicing and e-way bills, TallyPrime streamlines complex accounting processes.

The ability to import data from Excel, integrate with WhatsApp, and create custom dashboards empowers users to manage their financial data more effectively. Furthermore, multitasking capabilities allow for improved workflow efficiency, enabling teams to focus on strategic initiatives rather than administrative tasks. Embracing TallyPrime not only ensures compliance with evolving regulations but also positions businesses for sustainable growth in a competitive landscape. Transitioning to this advanced software is not just an upgrade; it is a strategic investment in the future of your business.